investment

ManipalCigna Health Insurance

ManipalCigna Health Insurance is a fast-growing health insurance provider in India, offering customized and affordable health plans for individuals, families, and senior citizens. With a strong hospital network of 9,000+ cashless facilities and high claim settlement efficiency, it ensures quality care and financial protection. Key benefits include no room rent cap, global coverage options, wellness programs, and chronic care support. Whether you need comprehensive coverage or top-up health insurance, ManipalCigna stands out as one of the best health insurance companies in India for personalized, value-driven healthcare protection.

Features and information

Hospital Network – 14,000+ (Very Good)

3 Year Avg. CSR – 82% (Decent)

3 Year Avg. ICR – 82% (Very Good)

Avg. Complaints – 29 Per 10,000 Costumer’s (Decent)

No Co-pay – ✅ Yes

No Disease-wise Sub-limits – ✅ Advanced plans

Free Annual Health Check-up – ✅ ProHealth & Accumulate plans

No Room Rent Cap – ✅ Premium plans

Pre/Post Hospitalization – ✅ Yes

At PolicyCompare, we’re more than a platform. We’re your trusted partner in building wealth and securing your financial future.

Our experienced team of financial experts helps you compare and choose investment options that align with your unique goals. Whether it’s mutual funds, retirement planning, or tax-saving schemes, we tailor strategies to match your life’s aspirations — not just market trends.

What sets us apart is our commitment to transparency, integrity, and customer-first thinking. We simplify the complex world of finance so you can make informed, confident decisions. With PolicyCompare, you don’t just invest — you invest wisely.

Investment Services We Offer

Smart strategies to grow your wealth confidently

At PolicyCompare, we offer a range of investment solutions tailored to your financial goals. Whether you’re saving for the future, planning retirement, or building wealth, we help you compare and choose the best options from trusted providers.

- Mutual Funds Diversify your investments across equity, debt, and hybrid funds. Choose plans based on your risk appetite and financial goals.

- Tax-Saving Investments (ELSS) Save on taxes under Section 80C while earning potential market-linked returns. Great for disciplined, long-term growth.

- Fixed Deposits (FDs) This plan covers damages to your own vehicle caused by accidents, theft, fire, or natural calamities — but doesn’t include third-party coverage.

- Child Investment Plans Plan for your child’s future education, marriage, or other milestones with tailored child-focused investment products.

- Retirement & Pension Plans Build a financially secure retirement with pension schemes and annuity plans designed to provide steady post-retirement income.

- Unit Linked Insurance Plans Start with basic term insurance and later convert it into whole life or endowment plan.Tailored for bikes and scooters, this plan includes both third-party and comprehensive coverage options for everyday riders.

- Get the dual benefit of insurance and investment in one plan, with flexibility to switch between funds as per market performance.

Top 10 Companies That Provide General Insurance In India

Essential Documents for Health Insurance Coverage

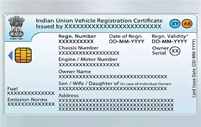

Proof of Identity (e.g., Aadhaar card, passport, PAN card)

Age Proof (e.g., birth certificate, school leaving certificate)

Proof of Address (e.g., utility bill, Aadhaar card, passport)

Duly filled application form

Income Proof (e.g., salary slips, income tax returns)